Learn how to change the number of days a trust receipt or payment sits in a pending state before funds have settled in your bank account.

Table of Contents

- Getting Started

- Setting clearance days

- How clearance days appear in triConvey

- Manually clearing a pending payment

- Frequently Asked Questions

Getting Started

Setting up accurate clearance days in triConvey helps your firm record correct payment dates and stay compliant with Law Society requirements.

You can also manually clear pending payments if needed, as long as you have the relevant permissions.

Setting clearance days

By default, clearance days are set to 5 business days. To change this:

1. Select the Settings icon on the bottom-left corner of the triConvey Companion Site Web App.

2. Select Firm Settings.

3. Select Payment Provider from the left menu.

4. Under the Clearance Days section, change the number of days to one that is most relevant for your firm.

5. Select Save.

How clearance days appear in triConvey

When a payment is within the clearance period, it will appear italicised in your list of payments, as shown below.

If a payment covers multiple invoices, it will show as one line item until cleared, then be applied to the relevant invoices.

The pending payment also appears under the invoice's payments tab.

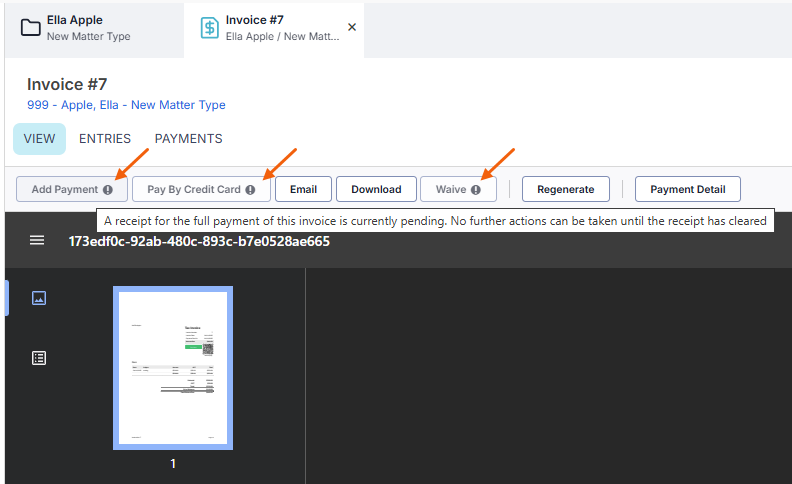

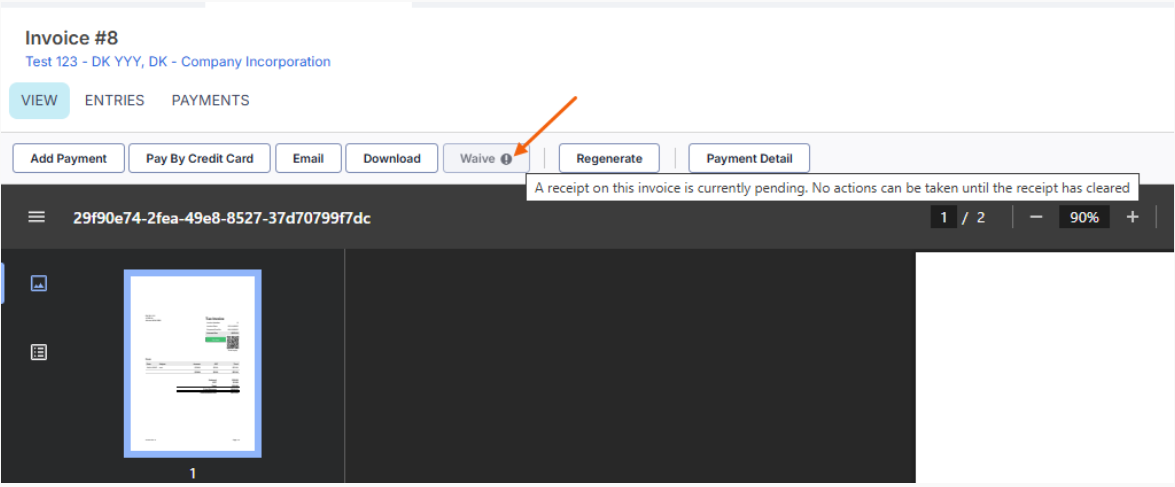

When there is a pending payment for the full amount of the invoice (i.e. it is within its clearance days period), the Add Payment, Pay By Credit Card and Waive buttons will be disabled.

When there is a pending payment for a partial amount of the invoice, only the Waive button will be disabled, and the debtor can only pay the remaining balance of the invoice.

After the clearance days have passed, the payment will display normally. The Transaction Date will show as the number of clearance days after the date the client made the payment.

How to find out your clearance days

Clearance days are the number of business days your bank takes to process a payment before the money is available in your firm’s account. To work this out:

1. Choose a payment made by a client today (or in the next few days).

2. Start counting from the next business day after the payment is made.

3. Stop counting when the funds appear as cleared in your firm’s bank account.

Handy Hints

- It’s better to overestimate the clearance period and clear the receipt early if needed, rather than underestimate and risk reversing a receipt that was marked as cleared before the funds arrived.

- We suggest processing more than one transaction before setting your standard clearance period, as the first payment a firm receives can sometimes take longer than usual to settle.

- By default, clearance days are set to 5 days. This is a general estimate given by our payment providers.

Manually clearing a pending payment

If a payment settles before the specified clearance days, you can manually clear the funds.

Before you begin

Ensure you or the staff member have the Clearance Override permission enabled. To check or enable this permission:

1. Select the gear icon on the bottom-left corner of the triConvey Companion Site Web App.

2. Select Firm Settings.

3. Select Staff & Users from the left menu.

4. Find the relevant staff member in the list and tick the Clearance Override box next to their name.

Tip: Staff members designated as Firm Owners will have this permission automatically enabled.

5. Select Save.

To manually clear a pending payment:

1. Click on the pending payment.

2. Enter a Date Cleared, along with notes in the Deposit Update Details.

3. Select Clear Funds.

Frequently Asked Questions

A Cleared receipt is a payment that has been verified and is officially available for use or reporting. Pending receipts do not affect account balances or reports until they are manually cleared.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article